As counties complete their reappraisals across the state we continue to hear that most are seeing historic or near historic increases in value. Occasionally there is confusion on how those value increases affect the property tax rate. It’s important to remember that reappraisals are revenue neutral with the intent being to equalize assessed values back in line with the current real estate market and not to create a financial windfall for the county.

How does one calculate a revenue neutral tax rate?

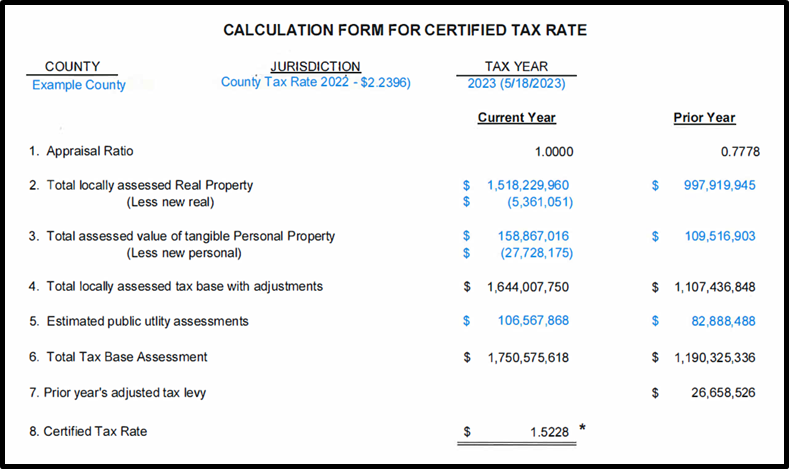

With reappraisals currently only occurring every 4, 5, or 6-years it may be difficult to remember all of the moving parts in the certified tax rate calculation. The calculation uses data from 2 different tax years. The year before the reappraisal and the year of the reappraisal. In the example below, line 7 provides the Prior Year Tax Levy of $26,658,526 which is divided by the current (Reappraisal) year Total Tax Base Assessment $1,750,575,618 seen on Line 6 and the results are a new Certified Tax Rate of $1.5228 as seen on Line 8 in the example below.

The formula looks like this: $26,658,526 ÷ $1,750,575,618 = 0.015228 or $1.5228 per $100 of value.

The calculation guarantees that the reappraisal, as completed by the Assessor of Property, is revenue neutral but does not prevent the county or city legislative bodies from exceeding the certified tax rate if the needs of the jurisdiction so require.

Another question that is often asked is, “What happens to the growth during a reappraisal year?”

Looking at the example below we see a deduction for new real and personal property on Lines 2 & 3. This deduction accounts for all new real and personal property that is being assessed for the first time during the reappraisal year and is not included in the certified tax rate calculation. If the additional $33M ($5.3M real + $27.7M personal) were included in the calculation it would cause the certified tax rate to adjust to $1.4945 and create a shortfall in revenue from what was collected in the prior tax year. The good news is that this is not the case and the growth is added back to the total base assessment after that certified rate is calculated for the benefit of the county and for the purpose of calculating the value of the penny.

For additional information regarding reappraisals and certified tax rate calculations contact your CTAS Property Assessment Consultant.

Example calculation: