Basic Steps of Establishing a CIP and Policy Considerations can be found under the Capital Budgets topic. Included is information on a committee or governing structure that identifies and starts the approval process for the capital program and funding approval.

A guide for approval of a capital project and related funding should follow the same procedures as adoptions of the operating budget; that guidance can be found in T.C.A. § 9-11-115. In summary, the code references adoption of an appropriation resolution, and then the related tax resolution for the operating budget. However, in the case of a capital project, a county could adopt a project budget known as the Project Budget Resolution (an example of a Project Budget Resolution is noted in figure 15) and then adopt the bond/note/loan resolution which we shall refer to as the Debt Resolution. Due to the legal nature of debt obligation as an attorney approved resolution, Debt Resolution allowing the government to levy taxes to repay the indebtedness will be required. This two step process allows the county’s related committee structure to work through gaining commission and public support for a project and related debt by gaining an understanding of the project needs and how the purposed project will meet the public purpose prior to action on a Debt Resolution.

We recognize that all counties do not approve a capital project and related debt in a two step process, but approve only the Debt Resolution. If only a Debt Resolution is approved, the budget approval is implied.

Recommended Practice: Establish a Capital Budget and post the budget on the accounting record. Provide it to the legislative body even if only a Debt Resolution has been adopted.

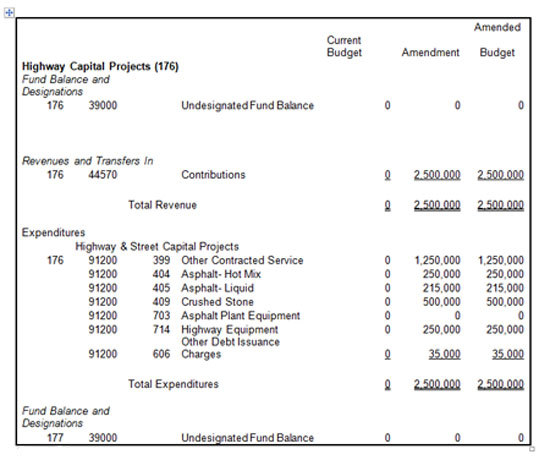

Figure 15

Figure 15