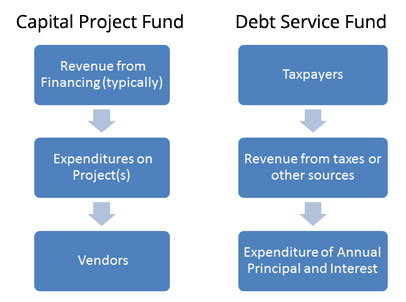

One common misconception when budgeting capital projects is the difference in the flow of money between capital funds and debt service funds. Almost always revenue for debt service will come from property taxes and other county money. As we have already noted, most money for capital projects funds are borrowed from financial institution (banks) by capital outlay notes and bonds are deposited into the respective capital project fund.

The outflow of money from debt service funds and capital project funds is also different. The outflow of money from the debt service fund is to pay back the bank for the expenditures of annual principal and interest. The outflow of money from the capital projects fund is for the expenditures on projects such as paying the vendors.