As we talk about the matching theory, we also must talk about the debt management and how this philosophy has been developed over time as we have managed our personal debt. The approach used as we manage our personal debt transfers to our beliefs, and sometimes our practices, of managing public debt. Some of us (or at least our parents) may not believe in having any debt, and if we believe in debt, have a very conservative approach to debt management. Others have a very aggressive management approach and thus one would anticipate having more debt. Consider that some of our parents, or even some of your classmates, may have paid cash for their homes. They built their houses as money was available or waited until they had accumulated enough money before they purchased their homes. Some people may have borrowed from family members (similar to an inter-fund loan). Others were willing to have a mortgage, but would never borrow money for any other items. Others would borrow for a house and an investment property, but nothing else. And still others would borrow to purchase a house, car, boat, investments, vacations, and maybe even their meals. These beliefs in debt management in our personal life impact our thoughts and decisions on how our government should borrow and pay back its debt.

What is important to know is that our approach to managing our government’s capital improvement and debt has a lot to do with our personal philosophy of debt management, which varies from person to person. This philosophy carries over further as we evaluate fixed or variable interest rate debt instruments.

We must personally examine to what extent and how strong our beliefs are on answering questions such as the following:

- Is it acceptable to have debt?

- What are acceptable assets for which to borrow money?

- Should our debt be fixed rate, variable rate or mixed debt?

- How long a time frame should money be borrowed?

Even if our personal belief is that we should pay as we go and not incur any debt for all practical purposes, it is almost impossible for the local government to acquire large assets without debt. However, even if we don’t like having debt and recognize the necessity for the local government in acquiring expensive assets, we can structure the debt policies and practices that only borrow for long life and high cost assets.

As we answer the questions above, we explore our risk tolerance in having debt.

We must examine our risk tolerance on whether debt should be all fixed interest, all variable interest, or a combination of both fixed and variable rates; and if so, what percentage should be fixed and variable.

The following spectrums will deal with our risk tolerance.

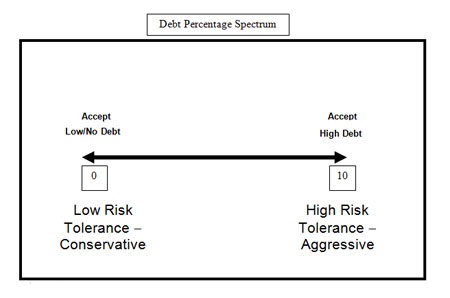

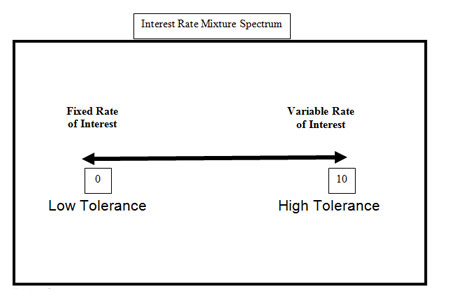

The concepts of our personal beliefs in debt, how much debt, and should debt be fixed or variable interest rates, can be depicted in the following low (conservative) to high (aggressive) risk tolerance spectrums. The first spectrum (figure 2) is a Debt Percentage Spectrum of total assets or an individual asset. The second spectrum (figure 3) is considered an Interest Rate Mixture spectrum.

If one were to place a home mortgage on the spectrum below, you could see this relationship of the risk as it relates to being conservative or more aggressive. Mortgage brokers generally like to loan no more than 80 percent of the value of a home, and if they loan more than 80 percent, they require the future homeowner to buy Purchase Mortgage Insurance (PMI) for the additional risk. A homeowner would like to have no mortgage debt, but may be willing to accept up to 90 percent mortgage in order to have the home asset.

Figure 2

Figure 2

This spectrum reflects a debt percentage of an asset or group of assets. Zero assumes that no money was borrowed to purchase the asset, and 10 assumes that 100 percent was borrowed to purchase the asset.

Using the same home mortgage and asset, you could plot a risk tolerance of whether the interest rate is fixed or variable. An individual may have a fixed rate if he/she has a large mortgage. The same individual may be willing to have a variable rate if the mortgage is lower, all depending on the risk tolerance of the individual and his/her expectation of future interest rates.

Figure 3

Figure 3

This spectrum reflects the extent that debt is either on a fixed rate, variable rate or mixture of rates. Zero represents that one does not like to be surprised by any change in an interest rate, and thus interest payments. Ten represents that one accepts, and will not be bothered by, a change in interest rates or interest payments. One could also speculate that a zero would be betting that interest rates are expected to go up, and a 10 would be betting that rates would go down.

Risk tolerance is not an exact measurement, but deals more with one’s disposition of how he/she feels about risk.

These debt spectrums can be developed to address the following four basic questions:

- Is debt acceptable and at what level?

- What are acceptable assets for which to borrow money?

- Should debt be fixed or variable?

- How long a time frame should money be borrowed?