Accounting Posting for the Receipt of Borrowed Funds

For the accounting staff that will be posting the accounting records for the county, the following journal entries (figures 6, 7, 8 and 9) would typically be found.

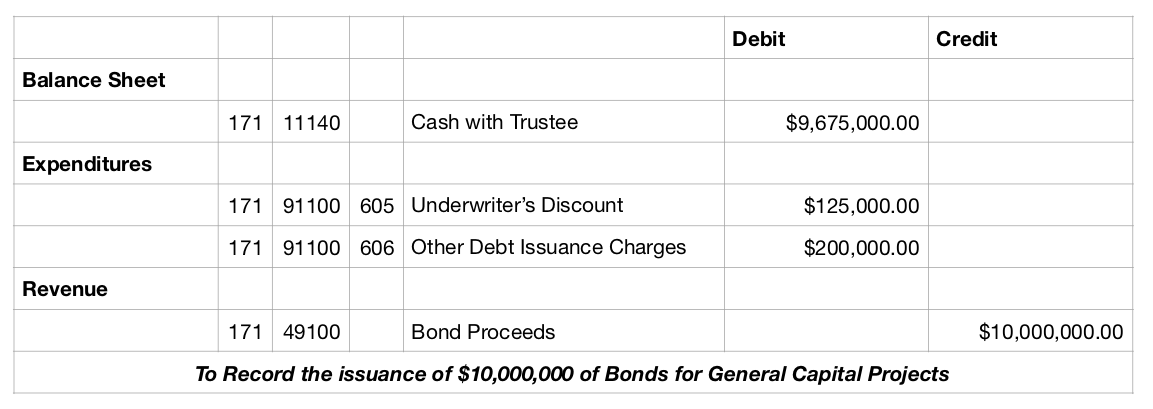

For Monies to be Received into the General Capital Projects Fund

Figure 6

For Monies to be Received into the Education Capital Project Fund

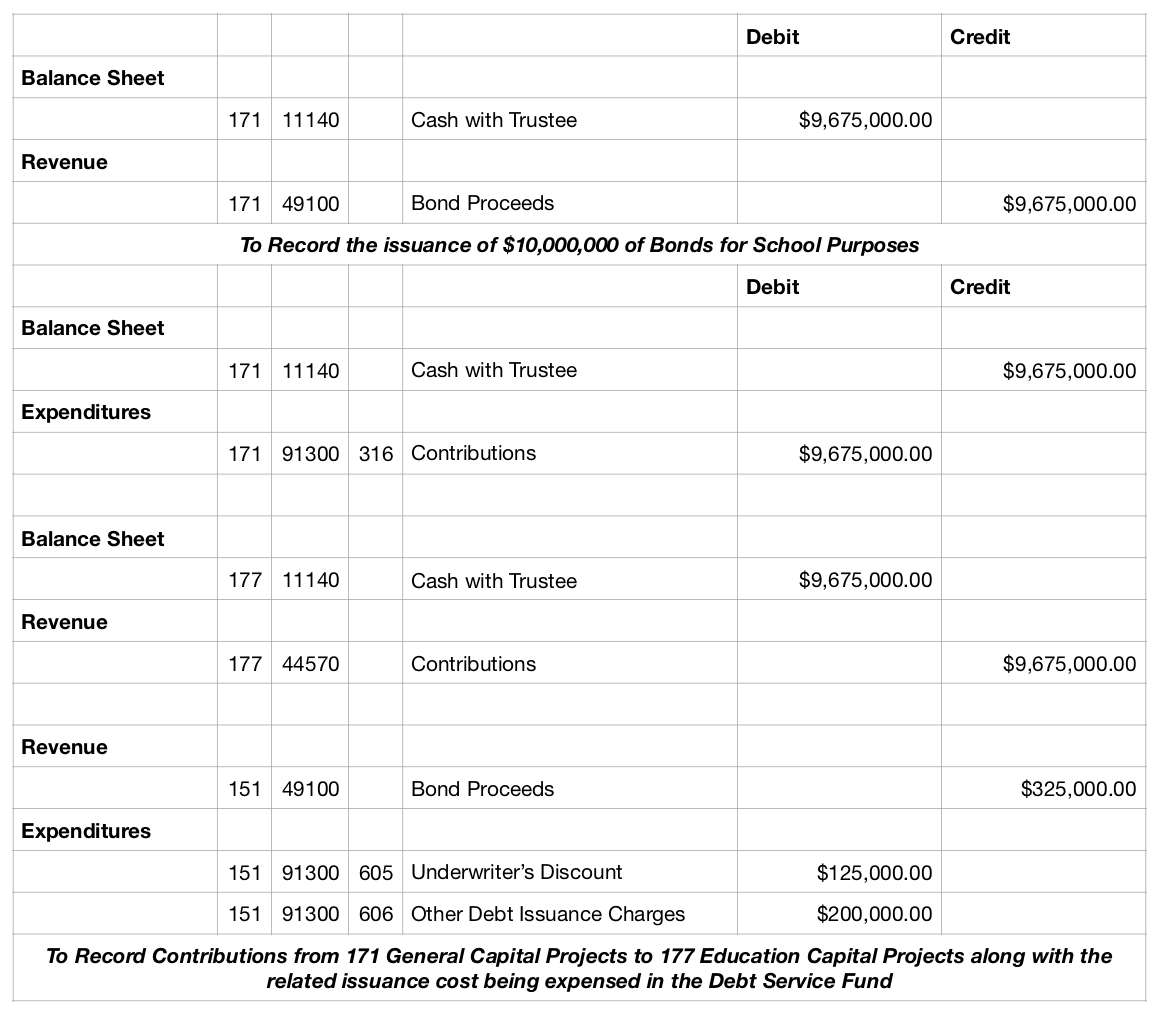

Before we list the accounting postings, note that these postings can vary from accounting system to accounting system. Also note that the recommended postings have changed in the last number of years due to the implementation of GASB #34. Since boards of education do not have debt issuance authority, they are prohibited from receiving notes/bonds/loans proceeds directly. The borrowed money must come into the primary government, and then the primary government can make a contribution to the component unit of schools. This contribution creates another question of the contribution being the total issuance proceeds less issuance cost, or the total proceeds and then allowing the issuance cost to be capitalized as a cost of the asset. Either accounting procedure of the issuance cost is permissible, along with allowing the cost of the issuance to be expensed in the debt service fund.

Recommended Practice: A county’s debt service policy should address how the issuance cost will be expensed or capitalized –not only for the education capital borrowing, but also for the general capital borrowing.

The following scenario (Figure 7) is of a county that has a General Capital Project Fund and desires to issue debt for a school building project with the issuance cost being capitalized as a part of the asset.

Figure 7

This second scenario (figure 8) relates to the issuance of debt for educational purposes, and reflects the debt service cost in the debt service fund and not capitalized.

Figure 8

These postings reflect that many options are available to receive and expend funds on capital projects. Other postings also are allowed. One should consult auditors or a CTAS consultant if questions arise on the posting of these proceeds.

Further, the above posting brings out a very important issue that often is overlooked and can cause shortages in the capital project. An asset cost generally is the full cost to put the asset into use. This cost includes the cost of the issuance of the debt. The project budget was originally established at $10 million. However, the first expense was not pertaining to the actual construction of the asset, but rather to the issuance of the indebtedness. The examples above reflect that the project has cash available that is $325,000 less than anticipated for the project.

A debt and/or capital projects policy should address the following: issuance cost; if additional funds should be borrowed for issuance cost; if this cost is included in the capital budget where the expense will be incurred; or if the cost of issuance would be absorbed by the debt service fund as noted in figure 9. Also note that the Debt Service Fund is a budget fund, and the budget should be amended to include any revenue and additional expenses.

Figure 9 reflects the Debt Service Fund paying the cost of the debt issuance.

Figure 9

Further depending on how the funds are borrowed, there could be interest earnings from the idle funds not yet expended and interest expensed during the construction phase. For example, the above $9.67 million could earn interest until used. These interest earnings would accrue to the Debt Service Fund and could be used to recoup the issuance cost and defray the interest cost of borrowed monies during construction. The earned interest is not eligible to accrue to the capital project fund.

Recommended Practice: Make sure all parties understand where the cost of the debt issuance will be charged and any interest earning deposited. Reflect this cost and revenues estimates in a budget.

While we are on the subject of cash availability, your debt policy should also address, either on a case by case basis or specifically state in the debt resolution, what will be the disposition of any unused funds after a project is complete. Generally the borrowing instruments state the proceeds shall be for capital outlay, thus allowing the county to use the proceeds for the project approved and any future approved project. Outside the broad language, the remaining funds are transferred back to the Debt Service Fund for the repayment of debt.

Recommended Practice: Allow all excess funds to be available for other capital projects upon specific approval.

Recommended Practice: If a permanent Capital Project Fund has not been established, then a county should take the opportunity to establish a Capital Project Fund with any excess cash.